Automated Oil Trading Systems: Minimal Effort, Maximum Potential

In the fast-paced world of oil trading, automated systems are revolutionizing the way traders approach the market. These sophisticated tools offer a way to capitalize on market movements with minimal human intervention, potentially leading to increased profits and reduced stress.

What Are Automated Oil Trading Systems?

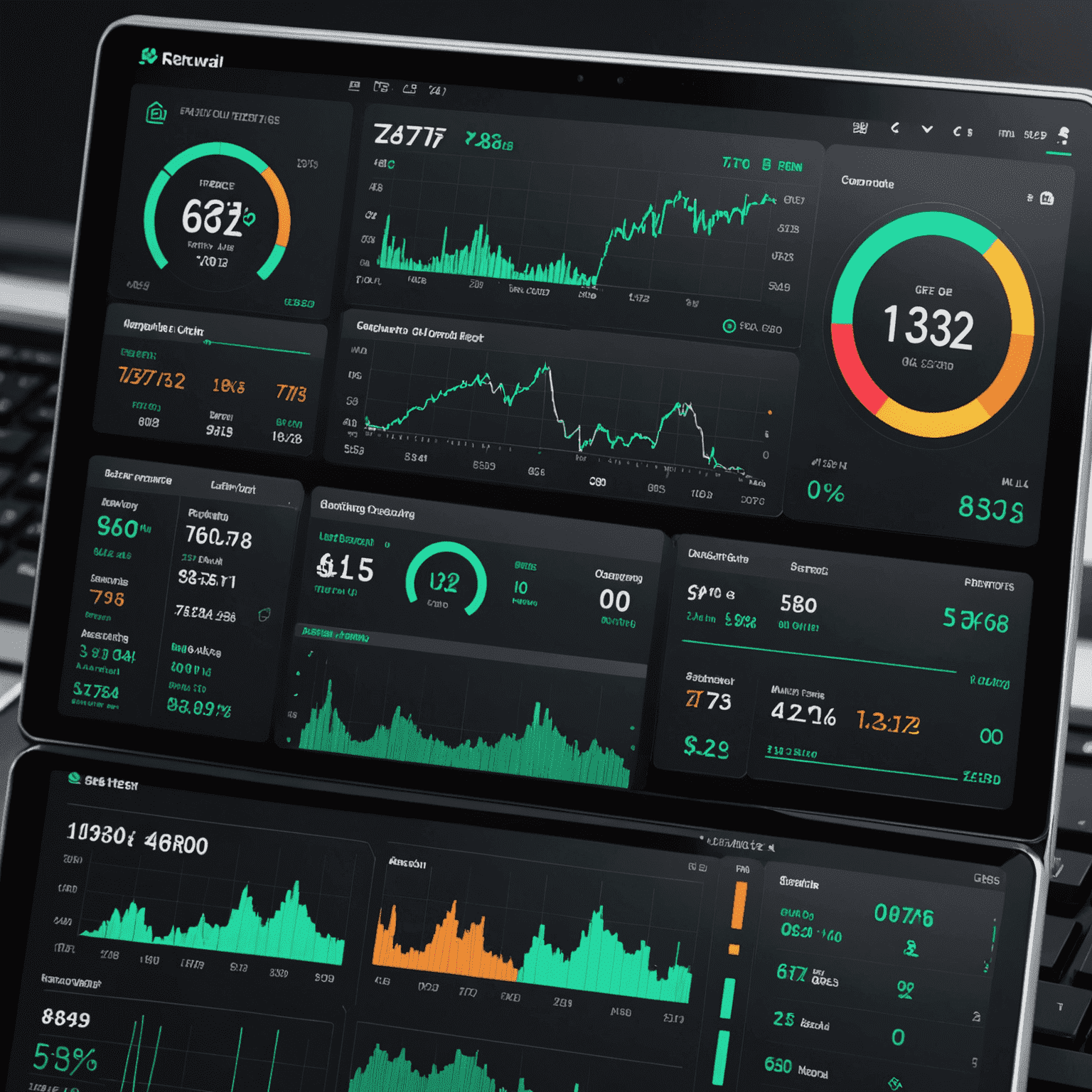

Automated oil trading systems are computer programs designed to execute trades based on pre-set parameters and market conditions. These systems can analyze vast amounts of data, identify trading opportunities, and execute trades faster than any human could.

Key Benefits of Automation in Oil Trading

- 24/7 Market Monitoring: Never miss a trading opportunity, even while you sleep.

- Emotion-Free Trading: Remove human bias and emotional decision-making from your trading strategy.

- Rapid Execution: Capitalize on market movements in milliseconds.

- Backtesting Capabilities: Test your strategies against historical data before risking real capital.

- Diversification: Easily manage multiple trading strategies simultaneously.

Implementing Automated Oil Trading Systems

To get started with automated oil trading, consider the following steps:

- Choose a reliable trading platform that supports automation.

- Develop or purchase a trading algorithm tailored to the oil market.

- Backtest your strategy using historical data.

- Start with small trades to test your system in live market conditions.

- Monitor performance and adjust parameters as needed.

Risks and Considerations

Despite the advantages, automated oil trading systems are not without risks. Market volatility, technical glitches, and over-optimization are potential pitfalls. It's essential to have a thorough understanding of both the oil market and the technology you're using.

The Future of Oil Trading

As technology continues to advance, automated trading systems are likely to become even more sophisticated. Machine learning and artificial intelligence are already being integrated into some systems, potentially offering even greater accuracy and profitability.

By leveraging automated oil trading systems, traders can potentially achieve better results with minimal effort. However, success still requires careful planning, ongoing education, and a willingness to adapt to changing market conditions.